Put Option Explained: A Step-by-Step Guide for Beginners

- Jul 3, 2022

- 4 min read

Updated: Oct 23, 2024

A put option is a derivative contract that gives a right to an option buyer, to sell an underlying asset at a pre-determined price (called the strike price) having a pre-determined quantity (called lot size) on a pre-determined later date (called maturity or expiry date). However, it does not obligate the option buyer to do so.

On the other hand, a seller of a put option contract has an obligation to buy the underlying asset if the buyer exercises his right to sell the underlying asset.

This right to the option buyer comes with a price (called option's premium) that a buyer of a put option contract has to compensate the seller at the initiation of the contract.

Example

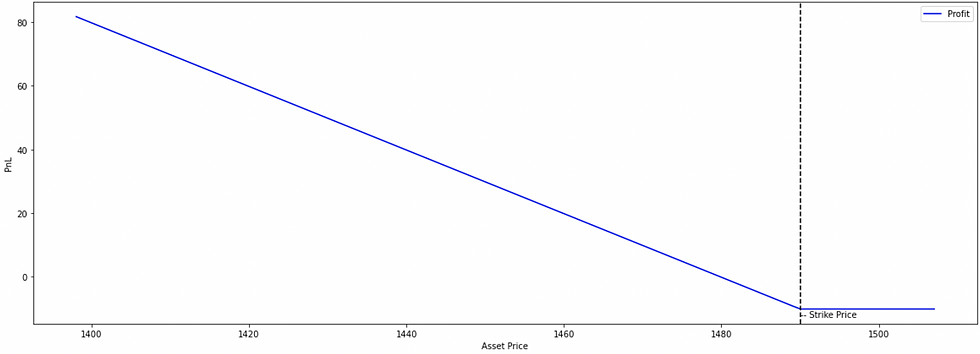

On 25Jan2022, A entered into a put option contract wherein he has a right to sell the underlying asset, currently trading at $1488.05, at a strike price of $1490.00 on 27Jan2022. The initial premium paid is $10.18

The primary objective of entering into this contract is that A is expecting the asset price to fall below the 1490-level by the end of the option period. If the underlying asset's price closes below the 1490-level on the expiration date (say at $1480.00), then A can exercise his option to sell the underlying asset for $1490.00.

"option buyer gets the right, not the obligation"

If the price of the underlying asset closes above the 1490-level on the expiration date (say at $1500.00) then A is not obligated to sell the underlying asset for $1490.00 instead A can sell the same in the market at $1500.00. In such a case, the put option contract lapses and the option seller will forfeit the initial premium of $10.18 received.

Observation-1: It depends on the moneyness of an option whether to exercise the right or not to exercise it. If a put option is trading "in-the-money", the option should be exercised.

Suppose, on the expiry date, the price of the underlying asset happens to be [$1478.05, $1468.05, or >$1488.05, or remains at 1488.05]

A will exercise his right to sell the underlying asset at the strike price of $1490.00 and the option seller is obligated to fulfill it. A has already paid the option premium of $10.18 at the initiation of the contract. Therefore, the effective realization from selling the underlying asset turns out to be $1490.00 - $10.18 = $1479.82

It also means that the minimum cost of buying the underlying asset to the option seller is $1490.00 - $10.18 = $1479.82

Before exercising the right, if A is not having the underlying asset then A can purchase the underlying asset from the market at the price prevailing on the expiry date. If the prevailing asset price happens to be as per below, the profit realization would be in line.

Observation-2: Once the contract is entered, the maximum that the put buyer can lose is the initial premium paid of $10.18

Suppose, on the expiry date, the price of the underlying asset happens to be [$1500.00, $1510.00, $1520.00, >$1500.00]

A will not exercise his right to sell the underlying asset at the strike price of $1490.00, rather A can sell the same in the market at an increased price. A has already paid the option premium of $10.18 at the initiation of the contract. Therefore, the maximum that the A can lose is the initial premium paid of $10.18

It also means that the maximum the seller can gain is the initial premium received of $10.18

Observation-3: The choice is indifferent between exercising the right to sell the underlying asset at the strike price or not exercising it if the price of the underlying asset happens to be equal to the strike price on the expiry date.

Suppose, on the expiry date, the price of the underlying asset happens to be $1490.00

Ignoring the qualitative factors, A is indifferent in choosing whether to exercise his right to sell the underlying asset at the strike price of $1490.00 or not to exercise it as the effective realization from the sale of the underlying asset will turn out to be $1490.00 - $10.18 = $1479.82 in both the choices.

Therefore, the breakeven point for the buyer is $1479.82

Observation-4: Assuming that the asset is not required for future use, entering into a put option contract instead of selling the underlying asset will (1). provide protection; paying a small premium amount to have an exposure on the underlying asset (2). limit the losses that the underlying asset may incur, but that is the next topic of our financial book.

Use Cases of Put Options in the Financial Market

One common use of put options is to hedge against market declines. By purchasing put options, an investor can protect their portfolio against potential losses in the event that the underlying asset declines in value.

Put options can also be used to generate income through the sale of put options. When an investor sells a put option, they collect a premium from the buyer in exchange for the obligation to potentially buy the underlying asset at a later date.

Put options can also be used to speculate on market movements. For example, an investor who believes that the price of an underlying asset will decline in the future may purchase put options as a way to profit from the potential price decline.

Comments